Reblogged from Brintab Corp.

As summer led to fall wild rebounding growth began to yield to taming. Markets were somewhat pulled back into line to begin to reflect a more conventional reality. Since investment markets tend to anticipate and “front run” what happens in the real economy, they responded accordingly.

Bonds and Interest Rates

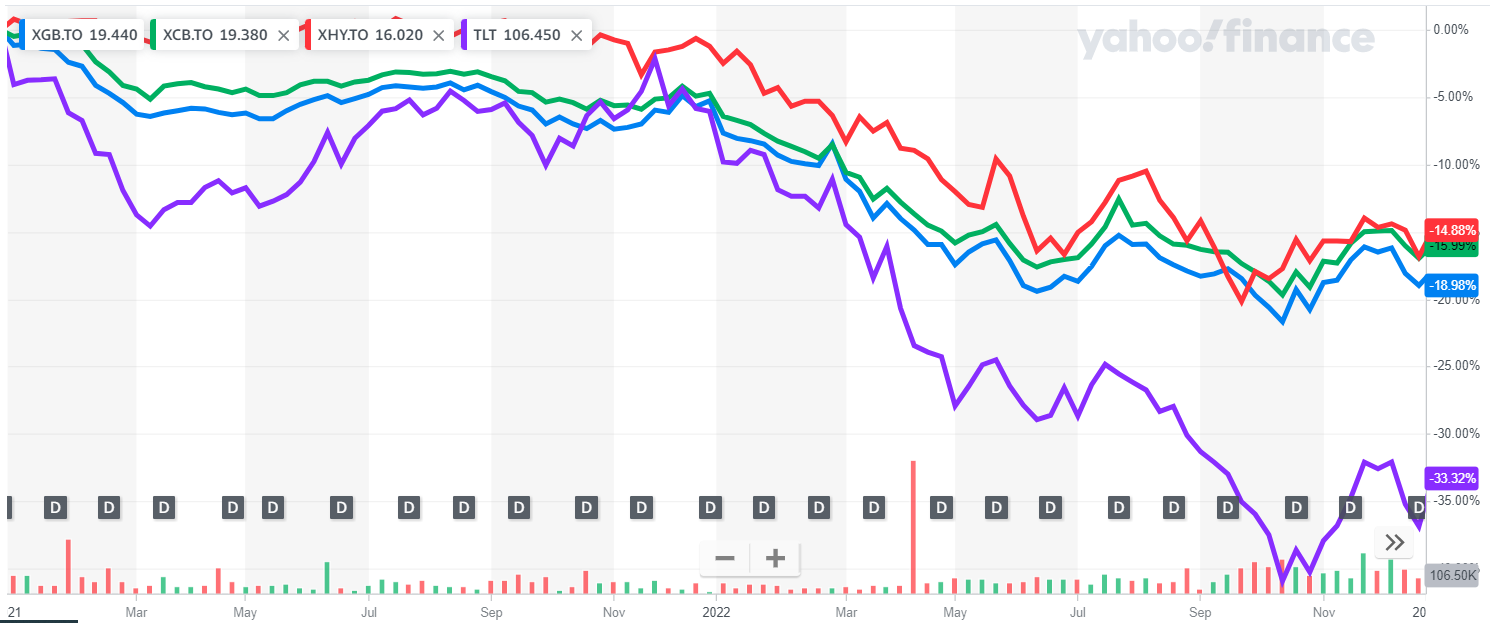

Central bankers in Canada and the US continued their drive to push interest rates higher to take the froth off the economy and get inflation back in check. Note in the chart below summarizing bond investments that the long-dated government bonds shown here (TLT in purple) dropped the most through the summer until finally finding their footing around early October. This quarter you can see that these long-dated bonds slowly began a stabilization/recovery. We continue to see inflation come down and although interest rates may stay this high for a number of months until the Bank of Canada and Federal Reserve are absolutely certain they have broken the back of the self-reinforcing inflation cycle, by the end of 2023 we expect to see inflation lower, unemployment rates rising, and thus Chairman Jerome Powell and Governor Tiff Macklin softening their talk and shifting towards the notion of easing interest rates.

Fig. 1: Bond ETFs: Gov’t:XGB, Corp:XCB, High Yield:XHY, US 20-yr:TLT–2 yr –Yahoo Finance

Note that the longer-dated bonds fall more than short-dated bonds in an interest rate raising phase and then on the flipside they generally rise more in an interest rate dropping phase. Therefore, it is my expectation that we will gradually be shifting to longer dated bonds through the year ahead. In industry lingo we would call this “increasing duration exposure.” To some extent you can already observe the beginning of our move. In December we began dipping our toe in with the purchase of some units of EDV, a very long-dated (high duration) bond pool. Moves like that will probably continue.

Currencies

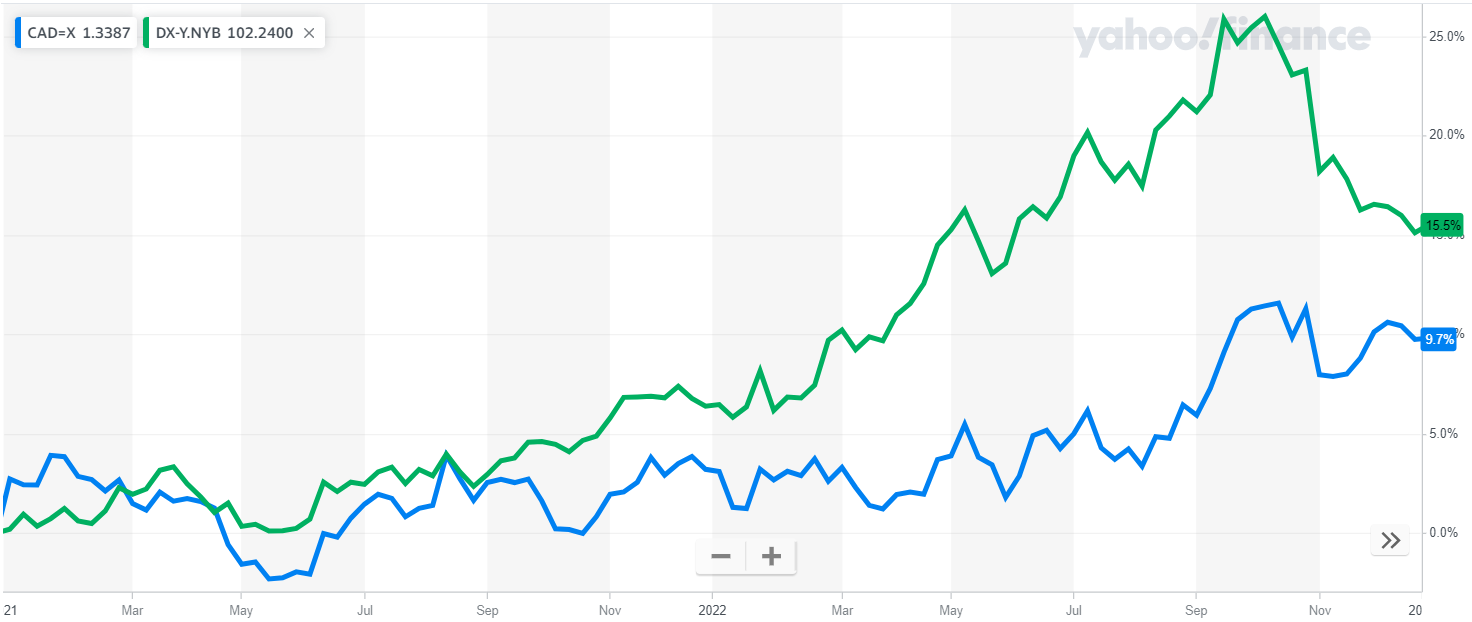

Back in October I talked about the difference between the USD/CAD behaviour and the USD behaviour against other major world currencies. Our expectations tended to be how things ultimately panned out this fall. Specifically, the Bank of Canada has been raising rates more or less in tandem with the US Federal Reserve. While the USD did strengthen somewhat vs the CAD through the summer (rising blue line in Figure 2), it was not as dramatic as the extent of the USD rise against other currencies (green line).

Fig. 2: US Dollar Index (green) and USD vs CAD (blue) – 2 years – Yahoo Finance

Now the Bank of Canada and the Federal Reserve are both slowing reaching their interest rate peaks while others are just in the early innings of their interest rate hiking trends. The outlook for interest rate hikes overseas explains why the USD has recently started falling back against a basket of foreign currencies (green line declining) this fall. With out graphing all the various details for you, I will note that of the CAD, the British Pound, the Euro and the Yen, it was the Yen that had the most astounding decline in the first 9 months of 2022 and then the most impressive rebound against the USD this fall.

Back in October I had indeed signalled expectations of the USD fading by the end of 2023 however to be clear I think its weakening against overseas currencies may be more pronounced than its moves against the CAD. The caveat to that is if oil goes higher the CAD will go higher.

Stock Markets

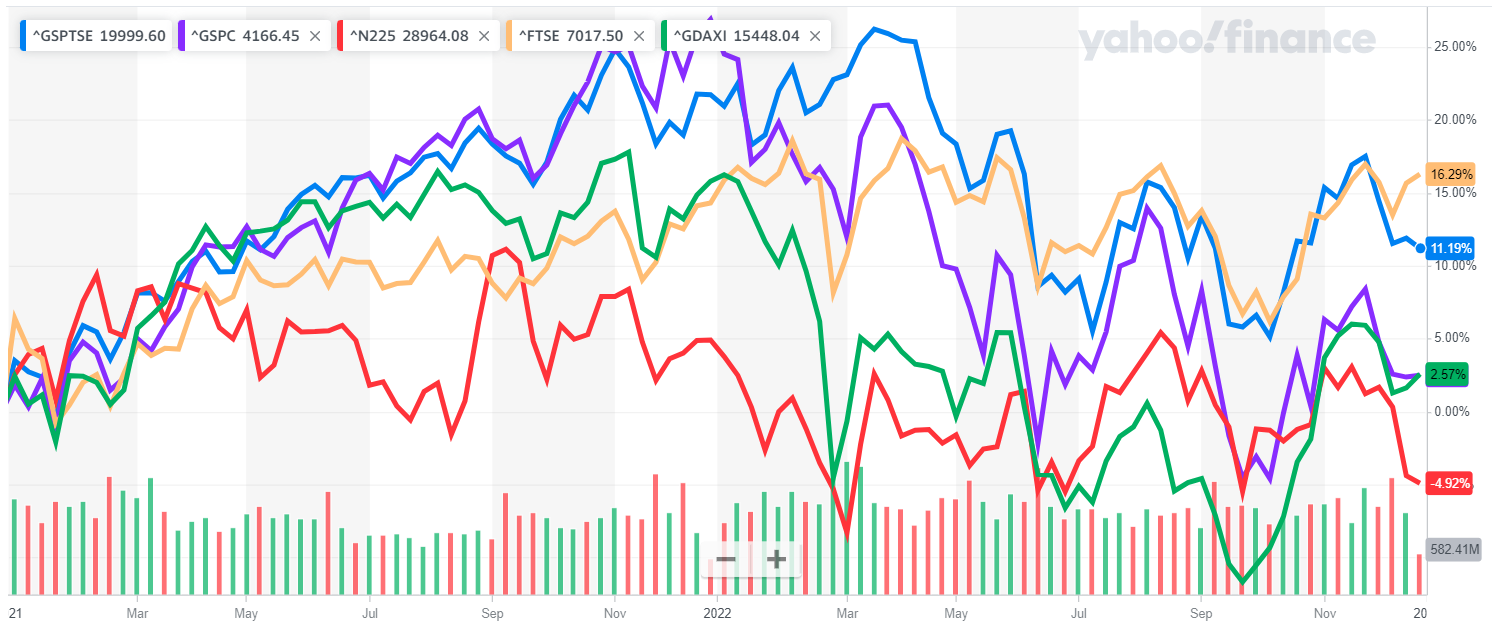

The gyrations of stock markets around the world were wilder than usual recently. This makes discerning comparative performance a little challenging but note that the Japanese market (Figure 3 red line) has been steadily declining for the past two years. Meanwhile the UK market (beige line) has gradually continued rising. The Brits are gradually getting past the Brexit heartburn that plagued their stock market. Also, the “Footsie” index has more mining representation than US indexes and recently those mining stocks have pushed the FTSE index higher.

Fig. 3: Equities: US-purple, Can-blue, Jpn-red, UK-yellow, Germany-green – 2 yrs – Yahoo Finance

While the US market has declined substantially from its peak at the end of 2021, part of this has been driven by its larger tech industry representation in the index. The tech industry has been significantly impacted by the post-Covid fade in tech spending and also by rising interest rates. That is not over yet. Cell phone makers, computer chip makers, and others in the tech space are still reporting tougher business conditions and we have recently seen layoffs at many tech companies.

While the economic cycle is largely unfolding as typical, there are a couple wrinkles we are watching. First of all, this fall China substantially opened up its economy from widespread Covid lockdowns. It could be they increase global demand, prolong inflation, and make central bankers around the world keep interest rates higher for longer. Despite the possibility, I do not think it will have a major impact. The Chinese economy is still heavily impacted by exports to USA, Europe, etc. and so with recession clouds in the West, it is hard to envision Chinese domestic consumer demand overpowering that.

The other consideration, particularly for Canadians, is how much oil demand will fade and recover through the coming recession. Rising oil will certainly complicate the job of Tiff Macklin at the Bank of Canada. I expect the oil story would be a tailwind for Canadian – more consumers doing well, railways, industrial equipment, and so many sectors feeling the boost. Nonetheless if it forces interest rates to stay higher for longer, staying away from interest rate exposed businesses will be a consideration.

Respectfully submitted,

Paul Fettes, CFA, CFP, Chief Executive Officer, Brintab Corp.

Leave a Reply

You must be logged in to post a comment.