reblogged from Brintab.com

During the summer we saw the first shoots starting to appear of interest rate increases reducing the extreme intensity of inflation and thus beginning to cool off the economy. More fading of high single digit inflation is likely around the corner so we can sigh about interest rates slowing and gradually stopping their recent relentless march higher.

Bonds and Interest Rates

Central bankers are routinely watching inflation rates and trying to boost interest rates when they need to slow down the economy to stop inflation getting out of control. This is a very tricky task since inflation, once in place, has a lot of momentum and can be hard to slow down. For example, if the price of oil rises then, plastics makers will at first absorb their input cost increase before gradually passing it on to plastics users. These plastic products makers, in turn will absorb some input cost increases at first before gradually passing that on to wholesale buyers, who will gradually pass the cost increases to retailers, who gradually pass it on to consumers. Then of course with consumer prices increasing, workers start to demand higher wages and a second wave of inflation rolls through the various participant companies in the economy. You can imagine that once the inflation ball starts rolling, it takes quite some time and quite some interest rate increases to tame inflation back down!

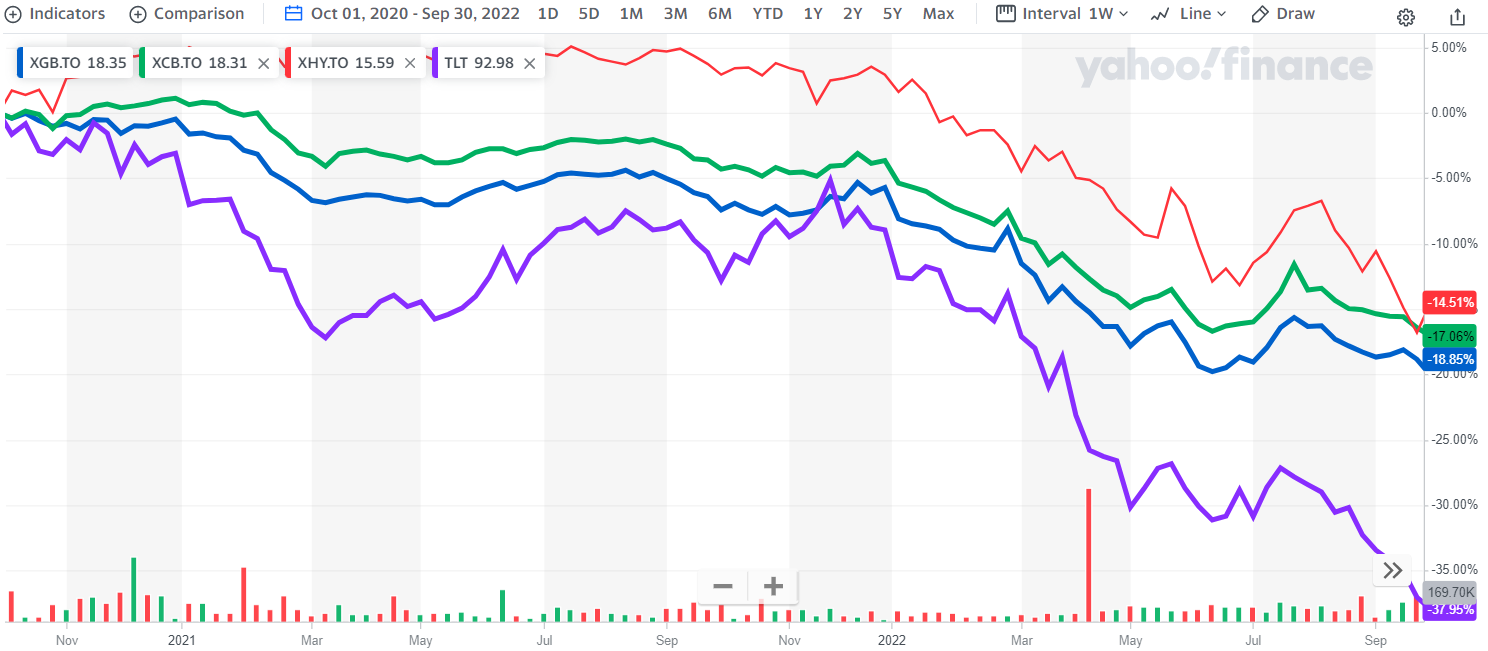

Fig. 1: Bond ETFs: Gov’t:XGB, Corp:XCB, High Yield:XHY, US 20-yr:TLT–2 yr –Yahoo Finance

As I alluded in the spring, central bankers in the US and Canada have certainly raised interest rates and even beyond that they have also telegraphed to the investment world that more interest rate increases are on the way. Nonetheless I do believe that this fall could see the end of the most acute interest rate increases, with possibly some small (0.25%) increases to follow next year. Other regions (e.g. the European Union and Japan) are further behind on their interest rate increases and may follow in time.

As interest rates have increased, bond prices have fallen. Figure 1 shows the impact on various types of bonds. Medium term government bonds (XGB) and Investment Grade Corporate Bonds (XCB), of which we often own some, have fared better than long term government bonds (TLT). We have been adding to TLT lately, thinking the majority of interest rate increases are likely complete. Our bias is toward still buying more long bonds although in taxable accounts there may be some tax-loss selling opportunities. High yield corporate bonds have also fared ok although we expect that the rising interest rates and pending recession will be hard on those high yield bonds as some of those companies face financial distress from having too much debt.

Generally, each month the government marches out the latest statistics on inflation. The statistics the media usually quote are the year-on-year inflation for the month. That statistic compares the most recent month’s prices to the prices in place for the same month a year ago. We recently looked deeper into the inflation statistics because this year-on-year number unfortunately masks exactly WHEN during the past year the inflation occurred. The month-on-month (rather than year-on-year) numbers give a hint to this although they are a bit messy. Messy because for example, there is much more Christmas shopping in November than in October and much less leisure travel in September than in August. You can imagine that looking at month-on-month numbers is a little like comparing apples to oranges. Still, we can see that as the economy recovered from Covid19 there was significant inflation back around October 2021. This leads me to believe that once we get this year’s October numbers (to be released in November) and this year’s November numbers, we will start to see the most extreme inflation fading. Furthermore, we have seen some commodity prices (oil, copper, natural gas) roll over this fall from the high values they experienced in the summer and oil first had its major rise around the time of the Russian invasion so by next spring we will be comparing oil prices to previous high numbers. To me, all this points to the gradual stabilization of prices and takes pressure off the need to raise interest rates much further.

Currencies

The biggest drivers of the moves of one currency against another tend to be a) the difference in interest rates in one country versus the other, b) flows to and from countries considered “safe havens” and c) in the case of Canada the price and volume of our top export – crude oil.

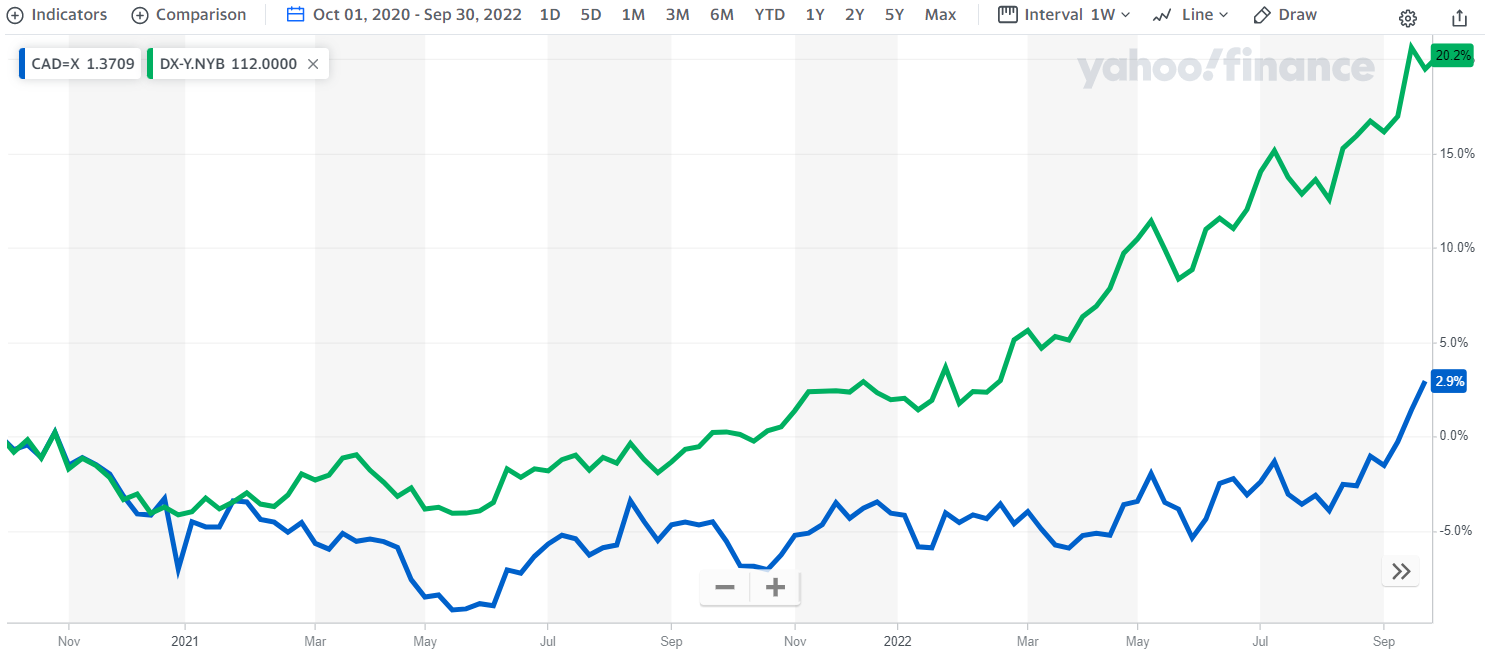

We can see from Figure 2’s blue line that it now takes more CAD to buy a USD (i.e. CAD weakening) than it did a year ago. The slow steady march higher for the USD accelerated in August/September this year to the point where at the end of September it took 1.37 CAD to buy a USD (reciprocal conversion rates is $0.73 USD per CAD).

Of course, if you look at the acceleration of the USD versus a basket of major global currencies (Green line) you can see that the USD really shot higher dramatically. In that sense the CAD held its own better than other currencies did. This is because the Bank of Canadian and the US Federal Reserve more or less raised rates in parallel.

As I mentioned in the bond discussion above I think the rate increases in the US and Canada are fairly complete, while other central bankers may still have work to do (UK, Japan, Europe). Thus, the substantial rise of the USD is likely to plateau in the next few months. There is still risk of geopolitical concerns (Russia-Ukraine, China-Taiwan) triggering a flight to a safe haven currency and surge in the USD but those are low-probability events in my eyes. In all likelihood I see the USD fading by late 2023.

Fig. 2: US Dollar Index (green) and USD vs CAD (blue) – 2 years – Yahoo Finance

The strength of the USD has held at bay many commodities priced in USD. It could well be that a fading of the USD leads to an aggressive rise in the prices of various commodities from oil to copper, gold, etc. These have all struggled lately.

Stock Markets

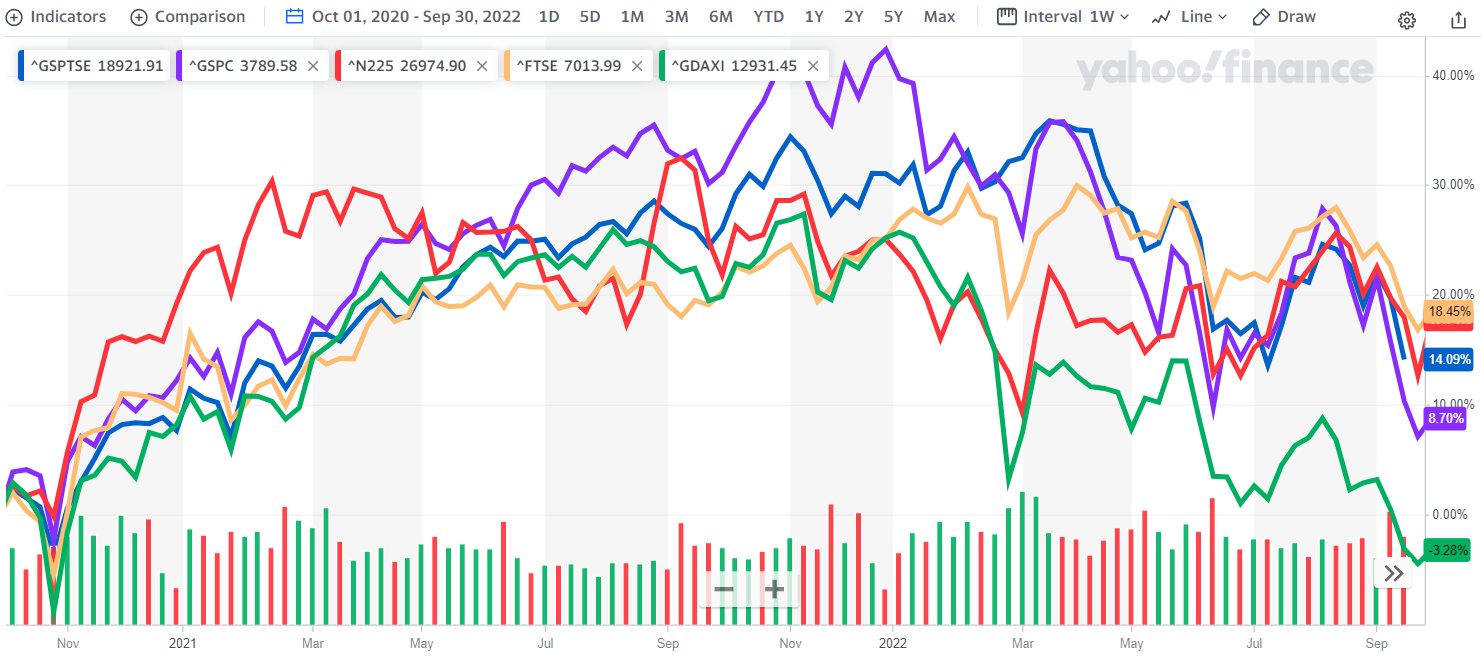

When we look at the performance of stock markets around the world, the one with the notably toughest past couple of years is Germany (Figure 3, green line). It was already struggling to keep pace with other world stock markets into the beginning of 2022 but then the Russian invasion of Ukraine and the corresponding skyrocketing of energy prices in Europe put the brakes on the German (and broader European) economy hard.

Also worth noting is that Japan’s quicker stock market recovery (in red) from Covid19 plateaued earlier and has somewhat struggled since. The US stock market has had the best recovery since March 2020 but then faced the largest pullback. I attribute this to the strong acceleration of US interest rates (which hurt stocks in general) and to the US stock market containing more high technology stocks than other parts of the world. Tech stocks tend to be harder hit by rising interest rates than other parts of the stock market.

Around the world, after most markets fell back in June, they rose again through the summer into August and then fell back at the end of September. We can never precisely predict where the bottom of the stock market will be and a long-term investor should avoid get distracted by spending too much time on it but suffice to say stock prices have now absorbed higher interest rates and a strong likelihood of a recession so they are much more modestly priced than they were a year ago.

Fig. 3: Equities: US-purple, Can-blue, Jpn-red, UK-yellow, Germany-green – 2 yrs – Yahoo Finance

Note that when I talk of a pending recession, the typical investor may suspect that means it is time to think about taking investment money off the table. Actually, the opposite is likely true. Statistics show that the stock market typically anticipates a recession by 6-18 months and so the stock market usually hits its lows (and starts rising up again) before a recession is even declared! This means that exactly when recession-watchers are tempted to reduce their bets, astute investors are often putting more investment money to work. Roughly speaking, we are somewhere in that space now.

Respectfully submitted,

Paul Fettes, CFA, CFP, Chief Executive Officer, Brintab Corp.

Leave a Reply

You must be logged in to post a comment.