Reblogged from Brintab

This winter we witnessed coping with foggy economic conditions in various parts of the world, from China to the Middle East, Ukraine, and North America. Not to say things were dire per se, but we waited for economic clarity on a number of fronts.

In the far east, we watched to see if China could cope with the struggles of a floundering property market and re-establish its solid growth track record. For years China has had weak consumer and made up for that with government projects around the country, building highways, railways, airports, power plants, and everything imaginable. At the same time, rural Chinese flocked to the jobs in the (primarily coastal) cities, driving real estate prices ever higher. When real estate started to flounder, regional banks looked exposed to mortgage and loan problems, the Chinese government stepped in once again, attempting to juice the economy with more government capital. The property market is still on shaky ground and in general economic growth in China is very weak relative to its historical track record. At this point, it appears that it might take China years to get through overcapacity – too many steel mills, too many condominiums that sit empty, and newly built roads to nowhere. The industrial growth that once drove Chinese equipment imports from the rest of the world is roughly flatlining so this informs our outlook for industrial companies wherever they may be located.

At the same time, hostilities continued in the middle east, involving ship attacks in Yemen, missile swaps between Iran and Israel, and various signs of risk of the Israel-Hamas conflict spreading and escalating. While the humanitarian impact is a widespread concern, there is also worry about the worldwide risk to the price of oil. This is happening at the same time as attacks by Ukraine on oil storage and refining facilities in western Russia. The American government is attempting to dissuade the Israelis and the Ukrainians from attacking oil facilities. While there are countless reasons to not want wars to escalate, it should be very apparent that rising gasoline prices in the US would throw salt in the wounds of inflation-weary voters right before an election. Not good for the incumbent Democratic president! In the Middle East, the flare-up between the Israelis and Iran seems to have somewhat calmed down (although peace between Israel and Hamas still seems out of reach). In Ukraine, it was likely hard to listen to US urging to back off on attacking refineries when the war chest was bare and it seemed that was one of the only tools left for Ukraine. Now that the US government (in late April) has agreed to renew support to the Ukraine military, their voice likely carries more weight in Ukraine. The risk of attacks extending from the initial target of Russian refineries/tanks to also include oil production facilities is likely off the table at least until US election day on 5 November.

Closer to home, we are seeing signs in both Canada and the USA that inflation is remaining more stubbornly high than expected by many (myself included). The stalling of the economic cooling off has bought some individuals and companies time to cope because unemployment has not yet increased and corporate profits have held up too. A delayed slowdown is good for anyone, personal or corporate, carrying a lot of debt. We will see how long it lasts.

Bonds and Interest Rates

Back in the fall, we experienced a phenomenal increase in bond prices. Remember that when the expectation for interest rates on newly bonds falls, investors flock to (and bid up the prices of) existing bonds in the market. If you look at the chart below, you can see that this happened to some degree to most bonds but the purple line (TLT) illustrates that this happened the most to long duration government bonds. This happened because investors thought the economy was cooling and so the central banks (Bank of Canada and US Federal Reserve) were going to start dropping interest rates.

Alas, it isn’t happening yet. Although inflation has subsided from its almost 10% peaks of mid-2022, it has stayed firmly above the 2% target. Although there are cracks showing in the economy (hours worked, part time vs full time jobs, etc.) it has not been enough to convince central bankers were are on our way to a cooler economy and lower interest rates.

Fig. 1: Bond ETFs: Gov’t:XGB, Corp:XCB, High Yield:XHY, US 20-yr:TLT–2 yr –Yahoo Finance

What is the implication? The bond markets got a little ahead of themselves at Christmas and this winter they have pulled back somewhat. We still feel bonds are going to be one of the best investments as things eventually cool off but that day of economic reckoning is still down the road. We are increasingly well positioned with bonds but those profits are likely a fall 2024 story. If the US government can finesse it, they would surely prefer for inflation to weaken but the economy to remain strong until at least November 5, just like their oil price bias. Back in January I voiced the opinion that bonds would eventually rise above their December 2023 levels and I still believe that to be true but as we can see from the chart above the path higher is going to be a little bit bumpy.

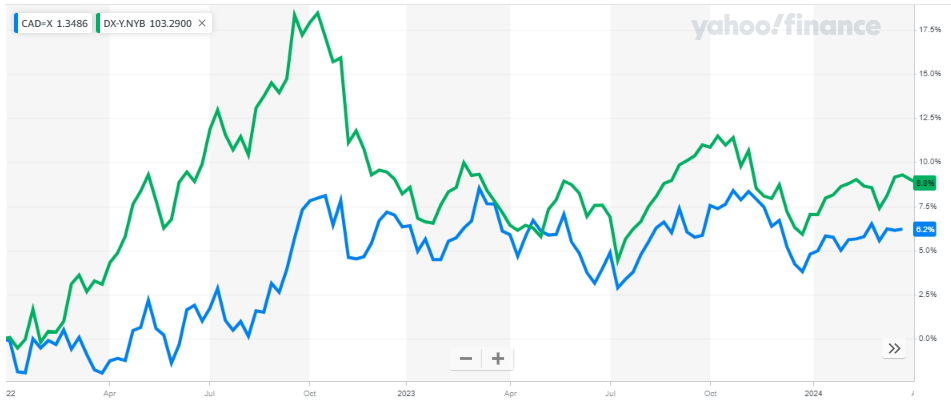

Currencies

Due to the stall in dropping US interest rates (and perhaps also due in some part to the winter’s geopolitical risk) the US Dollar gradually rose against most other currencies (or you could say the other currencies weakened against the US Dollar. The Loonie is trading in the 72s, a long way down from the 83 cents of three years ago.

Fig. 2: US Dollar Index (green) and USD vs CAD (blue) – 2 years – Yahoo Finance

Where do we go from here? There are two competing forces at play. In general, when the economy rolls over, the US Dollar briefly (for at least a few months) strengthens against most, the CAD. I have also talked frequently about how oil exports are really the foundation that supports the CAD. This month we have seen the completion of the Transmountain Pipeline which will drive more oil exports via the Pacific. Although the incremental capacity of Transmountain is small versus Enbridge’s Mainline to the US Midwest, that said it is a force at the CAD’s back. Hence, compared to the typical economic cycle, it is less clear than usual that the CAD has weakness in the cards for the near-term future. Our bias towards the USD is not as strong as it was a year ago when economic weakness seemed more imminent and the Transmountain completion seemed a long way off (if ever).

Merging this currency view with our bond outlook, we have been biased towards holding long-duration US government bonds but around the corner we may be adding some long-duration Canadian government bonds to the mix.

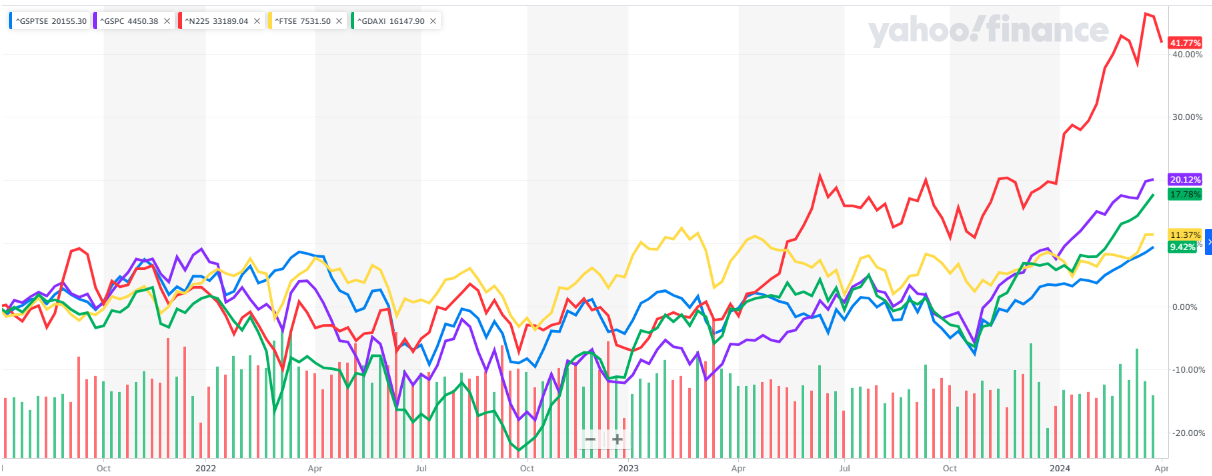

Stock Markets

This winter stock markets around the world have risen while bond markets have fallen. The Japanese market rose the most, thanks to belief that the multi-decade wallowing of Japan’s economy may be coming to an end. Among major markets, the UK fared the worst, followed by Canada.

Through the winter we have started to see signs of strength across commodities like oil, copper, gold, and silver. That is often the last stage for an economic growth cycle so we are watching closely.

Fig. 3: Equities: US-purple, Can-blue, Jpn-red, UK-yellow, Germany-green – 2 yrs – Yahoo Finance

This is third time in the past 4 years we have seen stocks zig while bonds zag. It happened for a few months in spring of 2023 and also back in 2020. That emphasizes the benefit of diversification but so far it has worked mainly to stocks’ advantage, not to bonds’ advantage. We expect to continue pruning our stock portfolio in the months ahead but that doesn’t mean we won’t deploy any money into stocks. We are always on the lookout for good companies, in stormy seas and in calm.

Respectfully submitted,

Paul Fettes, CFA, CFP, Chief Executive Officer, Brintab Corp.

Leave a Reply

You must be logged in to post a comment.