Reblogged from Brintab.com

As the winter progressed, markets were driven more than anything by increasing signs of successful vaccine rollout and hence risk reduction in the global economy. Early in the quarter markets bounced around a bit but the month of March saw full-speed ahead. The acknowledgement of the Covid 3rd wave did not yet appear evident.

Bonds and Interest Rates

As signs of increased certainty emerged (first a successful transition of presidency in the US and then increasing roll-out of Covid19 vaccines) the investment world gradually began to conclude that the central banks may not need to keep interest rates pinned down to the floor as long as originally thought. Rising longer term rates offered on new bonds means falling prices for existing bonds and so in February we saw government bonds (represented below in blue) and low risk corporate bonds (below in green) decline, before stabilizing in March.

This means that the “safe haven” part of portfolios struggled through the winter, but was offset by strong equity markets. Still, having some very low-risk, counter-cyclical investments is key to a long-term prudent portfolio and so we still see a role for these investments. It’s just that this quarter wasn’t their time to shine.

Fig. 1: Bond ETFs: Governments (XGB), Corporates (XCB), High Yield (XHY) – 2 years

Late in March we saw bonds bounce back a little bit. This may have been related to the surprising surge in the Covid19 third wave impacting Canada, various parts of Europe, India, Japan, Brazil, and others. While there has been substantial vaccine roll-out in the US and the UK, and also China has kept Covid19 spread under control, they can’t do it alone. Through the spring we will see how markets absorb the news of the third Covid wave.

Currencies

This winter was a tale of two worlds. If we ignore the brief spike down (USD weakness versus CAD) in the blue line of Figure 2, the general trend below over the past quarter was US dollar rebounding strength versus a basket of currencies but continued weakness against the Canadian Dollar. The Loonie has strengthened on the backs of rising prices for commodities (of which we export a lot) as well as the fact that the Bank of Canada seems more tolerant of rising interest rates here in Canada than central bankers in other countries. Indeed, the red hot Canadian housing market has put pressure on the Bank of Canada to raise rates a bit to cool things off. Meanwhile, the US has done better than other countries in rolling out vaccines so their interest rates might rise sooner than rates in other countries abroad. This has led to a bit of a recovery in the US Dollar versus some other currencies.

Fig. 2: US Dollar Index and Canadian Dollar versus the US Dollar – 2 years

A second factor is the probability of the US government approving a stimulus program worth over $1 trillion! To the extent that happens, the US Federal Reserve will certainly be likely to increase interest rates to keep the economy from overheating. All else being equal, such an increase in US rates would strengthen the USD versus other currencies.

Stock Markets

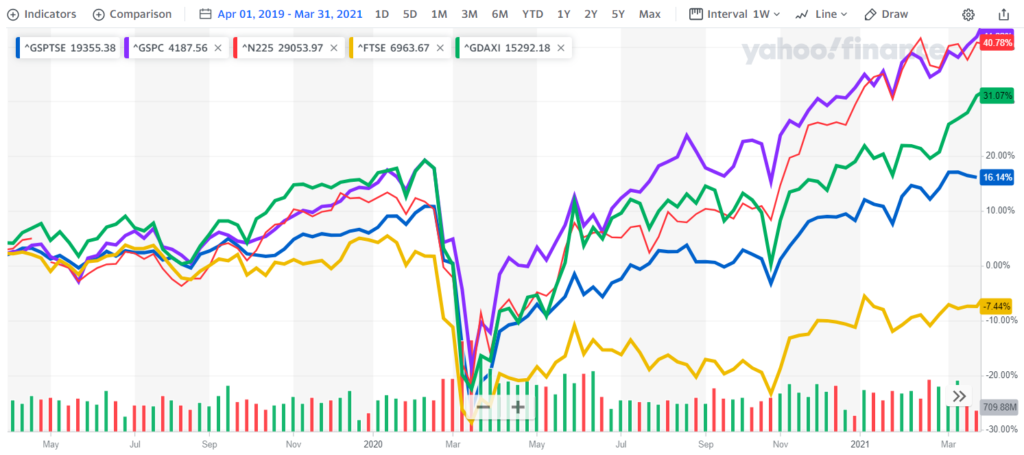

In January I commented on the major outperformance of tech stocks versus the rest of the market and how that, combined with US tech stock concentration, made the US market look so much better than others. Later this winter we saw a bit of a retrenchment of that differential. Although Figure 3 below still shows that the US market (in purple) as done the best over the two-year snapshot, looking at the month of March 2021 will show that Germany (in green), a major industrial goods producer and exporter, had the steepest rise, even steeper than the US market.

Fig. 3: Equities USA-purple, Canada-blue, Japan-red, UK-yellow, Germany-green – 2 years

In the time since the 2008 financial meltdown just over a decade ago, we saw many corporations use the presence of low interest rates to load up on debt and pay out profits to shareholders. They mostly did this by buying back shares in the open market and cancelling them. If the same company has fewer shares outstanding, then implicitly the value per share rises. There was a much weaker tendency by many corporations to reinvest in growing their businesses.

That may be about to change. There may be a significant refocus in the use of corporate funds. Just consider the following few examples:

- a transition to electric vehicles on the horizon

- a shift in electricity generation from coal to other sources

- a need to reinforce sea sides from rising ocean levels

- a need to refresh electrical distribution networks long left to perennial decline

- a reshoring of businesses due to geopolitical hostilities

- automation and artificial intelligence that triggers fresh innovation

We could dispute this, arguing that at any point in time there is always a long list of societal shifts that drive the need to invest in the future. Nonetheless, I view these shifts more as a series of long waves rather than a steady assent and after a decade with a dearth of reinvestment, I feel strongly that a decade of capital spending may be in the cards now. This logic is in sync with the recent rise in markets in Germany, a capital goods powerhouse of the world. This narrative will certainly impact our perception/ interpretation of the potential opportunities we scan.

During the quarter we had a couple securities held in various client accounts worth noting. For some time we have considered Shaw Communications as an undervalued stock. This winter Rogers and Bell decided they shared our opinion. A takeover contest happened for Shaw, with Rogers the likely winning bid. The price of Shaw stock leaped and we sold it shortly thereafter. Also during the winter, there was a takeover bid for Atlantic Power, a company whose preferred shares we own in various accounts. As a result, the preferred shares jumped. The bid was approved at a vote shortly after the end of the quarter and in time we expect the preferred shares to be sold.

Respectfully submitted,

Paul Fettes, CFA, CFP Chief Executive Officer, Brintab Corp.

Leave a Reply

You must be logged in to post a comment.