Reblogged from Brintab.com

After markets recovered this spring from the worst of the pandemic impact, the summer was a season of optimism, perhaps misplaced optimism, while a little bit of realism arrived with the coming of fall. There will likely be more ups and downs over the next few months in financial markets as an understanding of the long-term impact of Covid-19 gradually becomes clearer.

Bonds and Interest Rates

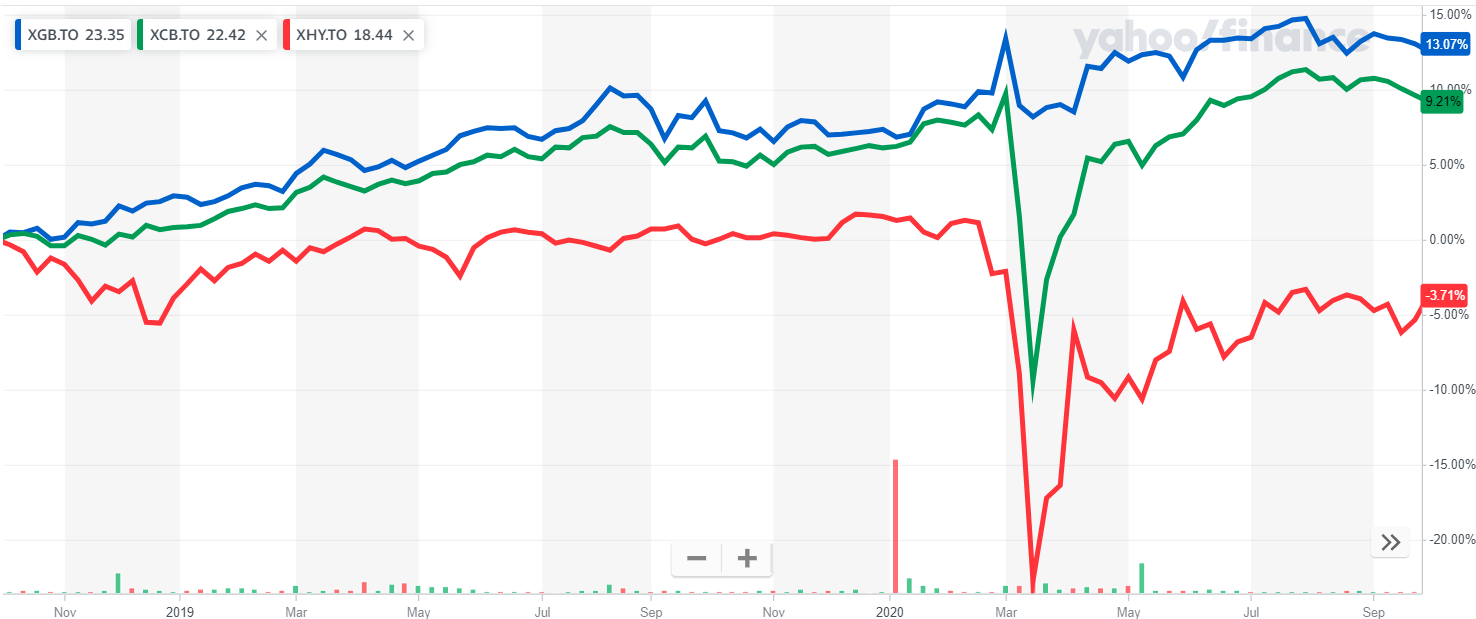

While the fixed income markets experienced a continuation of the springtime recovery in July, for the remainder of the quarter bond prices slightly faded as interest rates drifted higher. Late in the summer there were various signs that the economy was not recovering as quickly as hoped and the US Federal Reserve emphasized they would keep overnight rates low even while they allowed inflation to gradually rise and stay above the 2% target of the past. If there is longer term inflation on the horizon, long bond interest needed to rise (and thus bond prices needed to fall) to reflect that.

With the US and Canadian economies (as well as those in many other parts of the world) in dire need of government spending to prop the economies up, there is going to be a flood of government bond issuance to pay for it. It will take all the central bankers can muster to keep interest rates from rising. Central banks will be big buyers of government bonds to keep prices bid up (i.e. keep interest rates down).

Where do we go from here? Government bonds were a good safe haven during the spring and early summer. Now, it seems they face a stacked deck. Bonds might rise a bit, but on the other hand, there is a strong likelihood they will either stay flat (dead money with almost no yield) or fall off. In the income oriented space they may not be the place to be! Future-oriented income investors better be looking for more rewarding and potentially inflation responsive investments in the months ahead.

Currencies

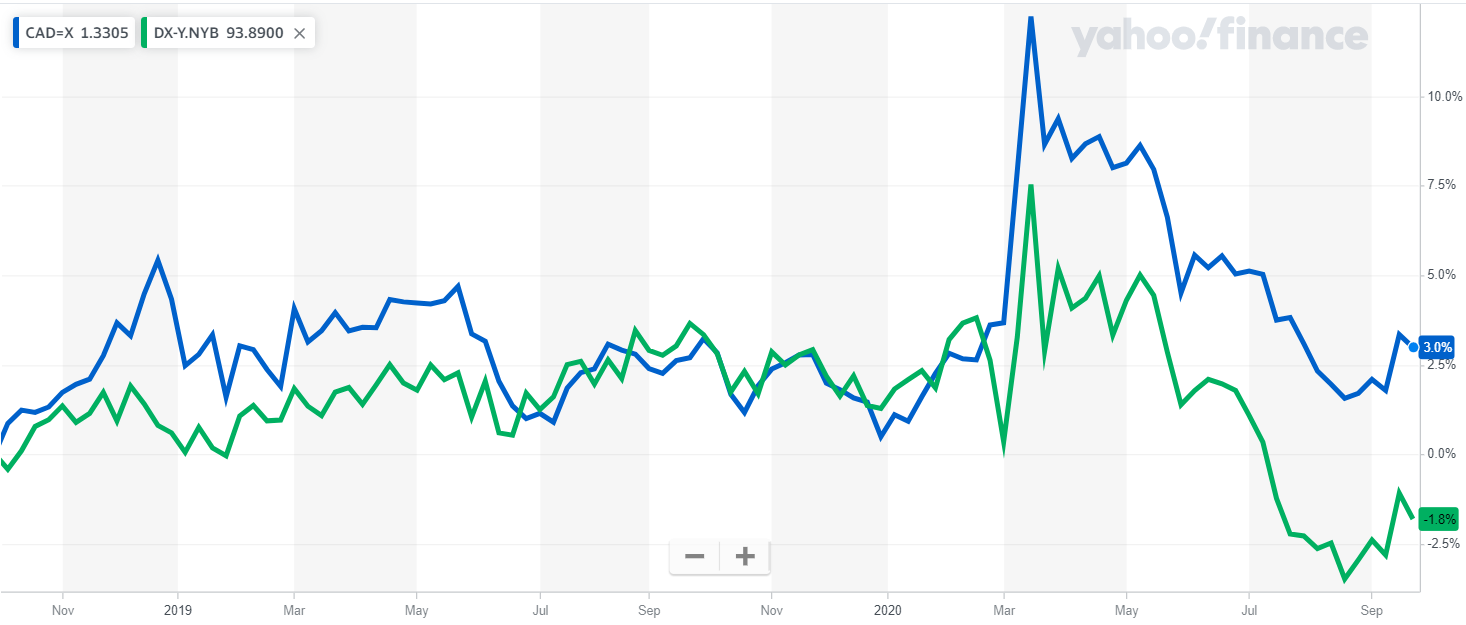

All through the summer the US dollar slid against the Canadian dollar and against a basket of other currencies, too. This amounted to not just the usual “risk on” trade but was strengthened by an exodus of currency traders from the US Dollar upon realization that the US government was going to be issuing a mammoth amount of debt (an inflationary pressure) and also the Federal Reserve was going to keep short term interest rates low (adding fuel to the inflationary fire) while the government issued the debt. High inflation is a good recipe for a declining currency, especially when the Federal Reserve declared that they fully intend not to pay enough interest to keep up with inflation. Unless you own stocks or something that is going to rise with inflation, the USD is a poor place to park your money. Of course, when risk briefly arose in September, investors flocked back to the “safety” of the US Dollar, however is that short-lived? Over the next 6-12 months I expect we will see the US Dollar flip-flopping before it trends lower, but lower against what? We know that the UK, Canada, Europe, and Japan all need to spend like drunken sailors to keep their economies afloat. Which countries are in a stronger position? China, among others. Generally speaking, developed country governments all went into this pandemic with a full serving of debt. Beyond China, the governments in the strongest debt position were primarily those forced onto a “debt diet” before the pandemic came along.

Are those glad tidings for the Canadian Dollar? Along with Australia, ours is one of the few major developed economies with a heavy natural resource exposure – in our case to oil. Even though oil is on the back foot right now with floundering demand and green investors steering investment money towards renewables, oil demand is global, encompassing many growing emerging economies. Oil prices will strengthen, and with oil prices the Canadian Dollar will eventually strengthen too. I’m not suggesting anything like trading at par to the USD, something it briefly flirted with a few years ago, but the leaning will be more towards a stronger Canadian Dollar than a weaker one.

Stock Markets

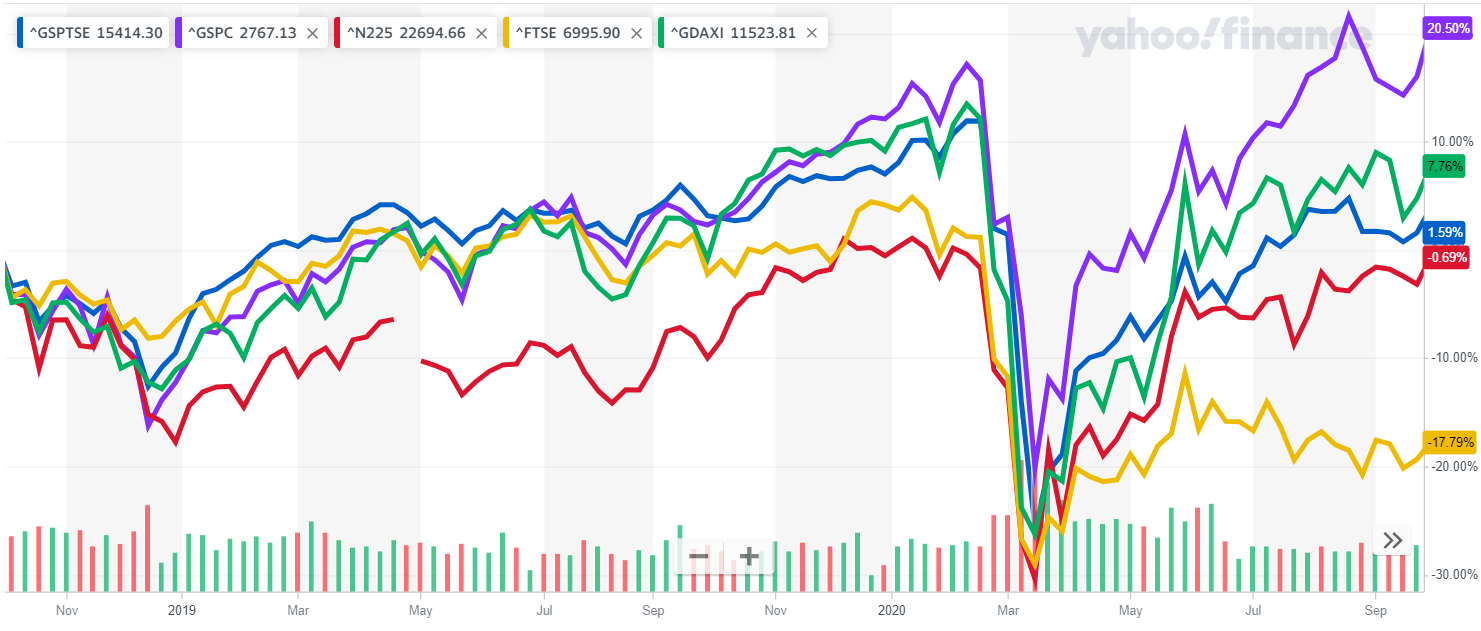

In equity markets a handful of tech stocks that were surrounded by euphoria dominated the US market. Other markets around the world recovered but did not do nearly as well. The driving force behind the economic recovery was the sense that the pandemic was being contained and everything would be okay. Spread of Covid19 in Canada and many other countries was subsiding and promises were being made that a vaccine was right around the corner. Late in the summer investors lost confidence in the lofty valuations of tech stocks. Adding to this, emerging statistics showed that fuel consumption during the US summer driving season undershot expectations and it became clear a vaccine was not close at hand and Covid cases were rising. The exuberance began to fade.

By the end of September, market participants became more focused on the “when” and the “how much” of the government stimulus, particularly from the US government. Also, markets began to slightly pivot towards industries that would benefit and away from industries that would be hurt by a Joe Biden presidency. This means some of our long-term business holdings have been hurt and some helped in the short term. We can see from the recent stock market dip (especially in the US) that investors are still coming to grips with the impact of the Covid19. Many businesses have clung on for dear life but (particularly retailers and restauranteurs) are bleeding red ink badly. I fully expect to see another market pullback in the year ahead as many storefronts close and at this point in time I am primarily choosing new securities with that outlook in mind.

Respectfully submitted,

Paul Fettes, CFA, CFP

Chief Executive Officer,

Brintab Corp./First Sovereign Investment Management Inc./Efficertain Corp.

Leave a Reply

You must be logged in to post a comment.