After President Trump’s “Liberation Day” triggered panic in April, the spring bounce-back gave way to continued turbulence over the summer. Key components of the driving dynamic were the political volatility in the USA with respect to internal and international issues plus the monitoring of the gradual success (both in Canada and the USA) of getting inflation tamed.

In Canada there has been substantial coverage of the Carney government’s vision of boosting domestic trade and productivity as well as intentions to dramatically expand international trade with partners other than the USA. Frustratingly, we have seen little more than talk so far, but of course we must acknowledge that it takes time for newly planted seeds to germinate and sprout.

Bonds and Interest Rates

Gradually there as been an increasing acceptance in recent months that extreme inflation is somewhat under control. In past quarters, when central banks dropped short term interest rates, the bond market pushed long term interest rates higher. This conveys bond market belief that central bankers were acting prematurely, dropping short term rates before inflation was properly tamed. More recently we have started to see long term rates falling, signalling market sentiment that inflation is coming under control.

Fig. 1: Bonds-Med. term Cdn Gov’t-purple, Cdn Corp-green, High Yield-red, Long Term US-black – 2 years – TradingView

In the bond chart above, we can see from the black line of long US bonds that starting in late May the trend hit bottom and started a gentle trend upward in long bond prices (implying a trend downward in long term interest rates).

This is welcome relief for us because the bond and fixed income portion of our portfolios has been mostly a source of challenging returns over the past year and a half, while stock markets have been a source of strength.

Right now, it appears that the primary sources of inflation in the USA are 1) reshoring manufacturing to the USA, 2) reducing the available US labour force by deporting non-documented workers, and 3) the substantial spending by the IT industry trying to implement Artificial Intelligence. With these factors in play, it seems the decline in inflation might be bottoming out in the USA, and hence the rise in bond prices may slow down. The one caveat here is that a fading in AI spending by the tech sector would really weaken the US economy and push inflation yet lower.

The factors in Canada are meaningfully different. The three mentioned above are certainly not the key drivers in Canada and in fact the reshoring of manufacturing to the US is working against the Canadian economy. In Canada, the once bubblish housing market has been a strong inflation factor that has now abated. Also, whereas US mortgages mostly involve rate lock-ins for 20-25 years, Canadian mortgages are much different, with rate lock-ins typically of 3-5 years. This makes the Canadian mortgage market (and by extension the Canadian housing market) much more responsive to short term interest rate changes. The declining interest rates in Canada are likely to have more impact driving a recovery in real estate trading than the declining US rates will have there. That said, we should expect a flattening of Canadian interest rate trends; not a rebound higher nor a substantial shift lower.

Currencies

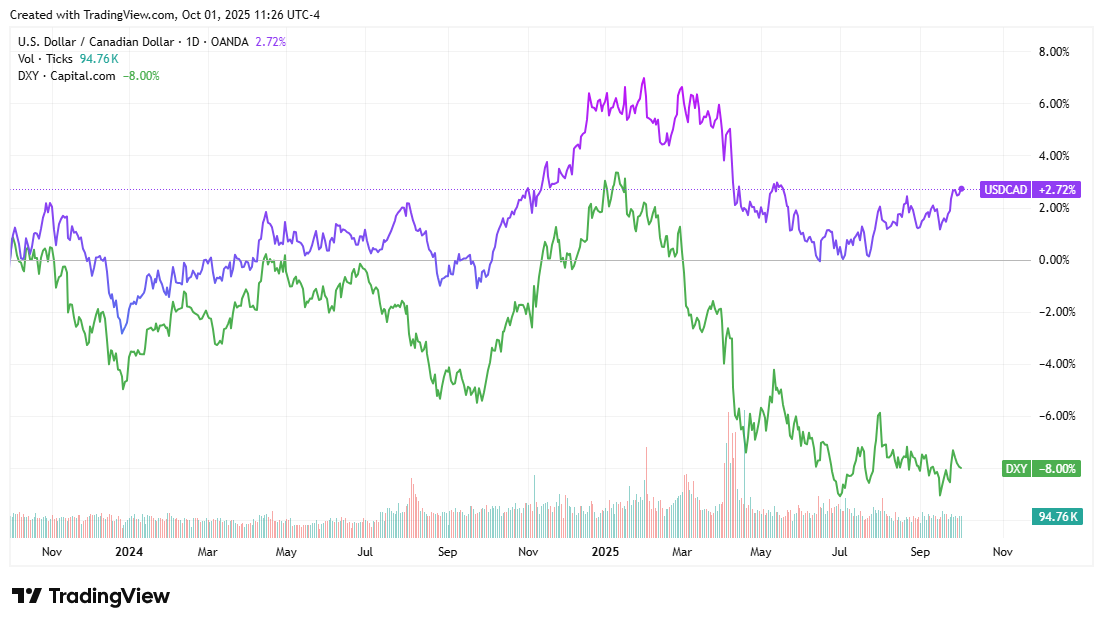

Over the course of the summer, if we look at the trends in the chart below we can see that the USD path with respect to the CAD (purple line) was quite different from the USD path with respect to a global basket of currencies (green line). We can see that the USD re-strengthened against the Loonie after its springtime fade but the USD weakened against the global basket of currencies. Another way to phrase this is that the CAD weakened against the USD and the CAD weakened even more against overseas currencies.

As is often the case, the CAD weakening happened in tandem with the price of oil weakening. Just after the end of the quarter US and European governments imposed substantial further sanctions on Russian oil. The timing of this was enabled by the fact that oil prices have fallen enough that their economies could stomach the oil supply tightening caused by the sanctions. Indeed, the price of oil did bounce slightly on the sanctions news but has since pulled back again. This signals that there is the potential for more oil price declines ahead. In particular, if there were any material steps towards a diplomatic solution in the Russian-Ukraine war, the potential for Russian oil coming back onto the markets would likely push oil lower and the CAD lower with it. As such, with respect to where the CAD sits now, I would say there is bias towards weakening. As a secondary factor, any economic/political disruption that triggered a rush towards safe haven currencies like the USD, Japanese Yen, or Swiss Franc would also be bearish on the CAD.

Fig. 2: US Dollar Index-green and USD vs CAD-purple – 2 years – TradingView

Stock Markets

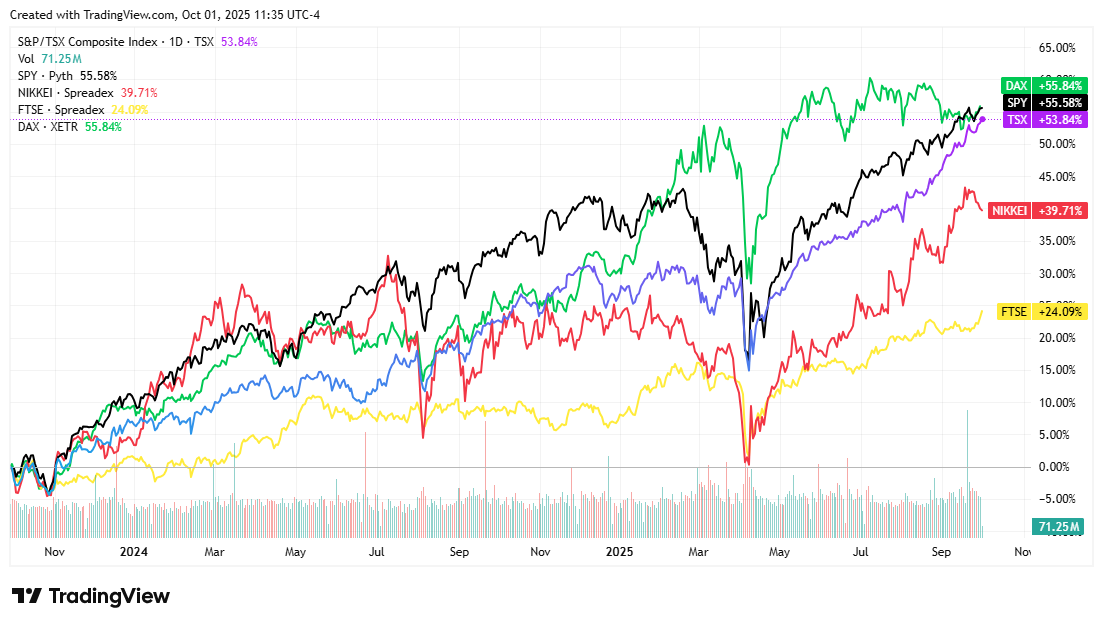

As shown in the chart below, after the spring’s recovery in equity markets, the Canadian, US and Japanese markets were strongest (with some volatility in Japan) while UK markets faded and German markets basically flat-lined. IT stocks led the charge in the US and the resource stocks (especially precious metals) drove Canadian markets higher.

In the US that IT-focused drive is expected to have less impact going forward as tech stocks are already at lofty valuations and their growth outlook is slowing down. In Canada, although some “gold bugs” think gold will go to the moon, realistically we won’t likely see near the precious metals dominance that we have seen in recent market behaviour.

Fig. 3: Stocks: US-black, Can-purple, Jpn-red, UK-yellow, Germany-green – 2 yrs – Trading View

During the quarter we did invest in a new holding PHYS, a Canadian gold ETF, that did well almost immediately. Going forward we expect more need to look for pockets of opportunity in specific stocks rather than just riding the general trend of markets as a whole. Since the US index is so tech dominant and Canada’s index is resource and bank focused, it is easy for the outperformance or underperformance of certain niches to be masked by the trend of the index as a whole. That is certainly happening right now.

Respectfully submitted,

Paul Fettes, CFA, CFP, Chief Executive Officer, Brintab Corp.

Leave a Reply

You must be logged in to post a comment.