Reblogged from First Sovereign Investment Management

Recently we in the investment world have been coping with the uncertainty related to the combative trade negotiations between the USA and China. When faced with the Trump regime’s caustic approach to trade negotiations, other nations (e.g. Canada and Mexico) have taken more of a placating approach. Conversely, China’s leader Xi Jinping has fought back aggressively and very publicly against the US stance. For example, state-run news agency Xinhua recently ran an article entitled “Forcing ‘America First’ on others will lead to ‘America Alone’” as a counterattack.

Through the winter the US government routinely released comments on how well the trade negotiations with China were going. Notably all through that period China was NOT releasing similar upbeat comments. Once talks fell apart this spring, there was a broadening of the issues tabled from trade alone to a long laundry list including issues such as Taiwan’s independence, Muslim minorities in China, Belt-and-Road Project’s alleged predatory lending, and control of the South China Sea. This morphed the narrowly scoped trade negotiations into an overall battle about America’s global dominance. The scope expansion and the entrenched positions of the two parties tell me we will wait a long time before seeing headway.

Adding yet another layer of geopolitical turmoil, the US government’s approach toward Latin American refugees has been all stick and no carrot but has not made progress on the issue at hand. The latest response was to target Mexico by threatening a stairstep series of tariffs on all imports starting June 10th.

What has been the result for investors? It seems like the negotiation rainmaker has become more of a storm-maker (let’s hope it’s a tempest in a teapot). If you look at the chart below of the S&P500 Index (US stock market indicator) you will see that in early 2019 the market rose up from the Dec 2018 lows but after the May 2019 selloff the US market is now roughly where it was almost a year and a half ago at the beginning of 2018!

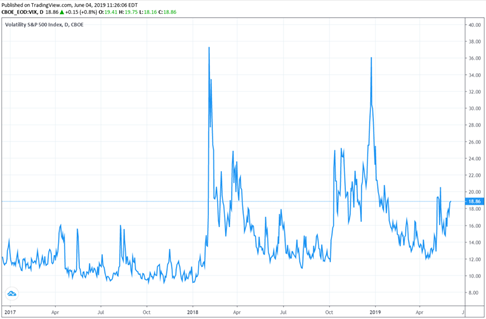

Meanwhile let’s take a look at the VIX index (below). This index shows the implied monthly volatility levels expected in the S&P500 stock index. You can see that through 2017 the expected volatility was generally confined to the 10-12 range but starting in 2018 it really rose up. Now the expected volatility tends to be in the 12-24 range with occasional spikes up into the 30s.

Some pundits claim we should not be too overly concerned by these sensational political headlines and just focus on what is happening in the real economy. I disagree. Solely monitoring the real economy is like looking in the rear-view mirror instead of looking toward the future. The real economy is driven by spending (mainly consumer spending and business investment spending). The ebbs and flows of spending depend on consumer and business confidence. The link to the real economy is that headlines can sow the seeds of worry, then worry can spook confidence, and weakening confidence can soften spending, both at the consumer and the business level.

But let’s not be chicken little; the sky’s not falling. In the world of finance here are a few tidbits I have learned over more than two decades in the industry:

- At the core of the investment process, prioritized above regular stock selection, first come strategic asset allocation and diversification. While we constantly search for specific investment opportunities, we start with setting the right strategy and ensuring diversification as the top two priorities. This implies staying strategically focused on the long term.

- Bear cases are seductive arguments. Because the media tend to grab sensational, often worrying stories, it is always easier to put together a so-called ‘air-tight’ hypothesis based on downside than on upside. Despite these fearmongers, over many decades markets have risen as companies continuously invent and create. Thus, we need to beware of falling prey too easily to bear case hypotheses.

- If you can tolerate volatility, then volatility can be your friend. We aim to buy stocks where the stock price undervalues the business and sell stocks where the price overvalues the business. To do this we rely on the twin emotions of fear and greed in the market pushing around stock prices until they reach unreasonable levels (too low or too high). If the market did not have this emotion and volatility it would be harder to find mispriced stock opportunities.

- If you watch the news media, the primary advice is to get out of this industry/sector; get into that one; get out of equities; get into bonds; get into equities; time to buy gold. This approach to investing is referred to as market timing. Market timing is one of the most difficult tactics in investment management. While this may make good news fodder, most people trying to implement it will not get the timing perfect and analysis shows that if your timing is off by even a little bit, you don’t make the profits and potentially lose money. That’s why many experts call overall market timing ‘a mug’s game.’

- Indirectly a value investing approach will often automatically adjust asset allocations to reflect the ever-changing economic cycle by looking at company valuations. This can lead us to buy industrials when the time is right, and likewise utilities, etc. When we sell a business and raise cash, we are looking for places to reinvest that cash. Often the stocks most out of favour will have the lowest prices and look the most appealing. This value-focused process often leads to buying out-of-favour stocks and naturally preparing for what will do well in the future rather than what has done well in the recent past.

Do today’s circumstances represent a rare occurrence? While some commentators like to blame the entire situation on President Trump, the reality is that if we look back through past economic cycles we see that this has happened before. Often, early in an economic recovery the market rises up relatively smoothly. Then later in the cycle when the recovery becomes more “mature” we tend to see more volatility and periodic pullbacks. Later stages of an economic recovery are never as smooth as the early stages. For example, if I look at my own personal portfolio I see that after the winter’s rise up, the portfolio was down 4.5% in the month of May. Then from May 31 to June 11th it was back up from the 1.3% in the next 7 trading days! I expect these bigger routine moves will generate opportunities on both the stock buying and the stock selling process.

Paul Fettes, CFA, CFP

CEO, First Sovereign Investment Management Inc. and Efficertain Corp.

Leave a Reply

You must be logged in to post a comment.